The Best Travel Medical Insurance For Digital Nomads

By Jessie Festa. This guide to digital nomad health insurance contains affiliate links to trusted partners – like SafetyWing, which I’ve used many times over the years. I only ever recommend products I love and think you would love, too!

If you’ve ever searched for travel medical insurance for digital nomads before, you probably realize there are many options out there.

At first glance, these companies may look the same; but the truth is they’re very different.

One popular digital nomad travel insurance option that covers you for a lot but is still one of the most affordable is SafetyWing, my personal top pick. I’ll be going over in-depth in this post so you can be very clear on exactly how you’re protected abroad.

The reason I’m choosing to highlight this product, in particular, is that it is unique — travel and safety insurance made by digital nomads for digital nomads.

The truth:

After going on numerous trips without issue, it can be easy to think you don’t need travel medical insurance abroad.

But it only takes one bad accident to lose everything — or be thankful you were covered.

Still skeptical?

Along with essential advice, I’ll be sharing stories below that prove just how vital being insured as a traveler really is.

Psst, don’t forget to pin this post for later!

Travel Insurance vs Health Insurance

There is a difference between travel insurance and the health insurance you have in your home country.

Yes, it’s important to have health insurance if you have a permanent address somewhere; but this won’t be enough once you leave home.

For instance, most travel insurance policies do not cover things like routine medical checkups, preventative care, cancer treatment or pre-existing conditions — though note SafetyWing does offer limited coverage for acute onset of pre-existing conditions.

On the flip side, your health insurance won’t cover lost luggage, trip interruption, and trip cancellation. Actually, most only offer limited medical coverage abroad and won’t cover evacuations, either.

Tip:

Before traveling, it’s wise to contact your health insurance to see exactly how you’re already covered.

Learn more about SafetyWing here!

Proof You Need Travel Insurance

If you’re asking yourself “Should I get travel insurance?” let me share a few stories that prove you do.

1. An Unplanned Outpatient Medical Procedure

“I have been circumnavigating the world under sail full-time since February 2013.

In 2015, while sailing in New Zealand, I required an unplanned outpatient medical procedure.

Not a trauma situation, but one that required urgent attention.

Without travel insurance, I would have incurred significant expenses paying for the procedure locally or trip delays and similar expenses to fund a trip to the US where I am covered by a primary insurance plan domestically.

Luckily, I was covered by my travel insurance and they paid for the surgeries.”

-Lisa Dorenfest of lisadorenfest.com

2. Clipped By A Mini-Bus In Mozambique

“I’ve been lucky enough to never have needed to claim on my travel insurance; however, my sister had to a few years back when her arm was clipped by a mini-bus taxi in Mozambique.

The driver was trying to avoid potholes and brushed her arm.

The fracture wasn’t picked up in Mozambique because of outdated equipment, but she was in a lot of pain at her next stop in Hong Kong.

When she had it checked out again, a fracture was discovered and she had treatment, and then was flown home in business class thanks to her travel insurance.

For me personally, I don’t really care about insurance for lost items, even though it’s nice to have.

What I really do care about is if something happens to me like getting hurt or injured and I need to get back home as soon as possible, or I require treatment in a decent medical facility.

-Anthony of The Travel Tart – Offbeat Tales From A Travel Addict

3. Dangerous Bus Station Bathrooms

“After a pleasant week exploring the Mekong River from Luang Prabang in Laos, we decided to head out to see the Plain of Jars.

We never got to see them. After a seven-hour ride in a bus — more like a minivan on steroids — we arrived at a basic bus station in Phonsavan.

My husband went to use the toilet.

On coming out of the loo, he missed a step and did a tricky dance down the stairs, breaking his leg in two places in the process.

As the medical facilities aren’t very good in Laos, the ambulance rushed us across the border to Thailand.

Luckily, our travel insurance took care of everything. We were so thankful we had it. If we hadn’t, this little disaster would have been much worse.”

-Trina and Tim of TeamHazard Rides Again

Keep in mind, these are just a few of countless stories showcasing just how vital travel medical insurance is.

Learn more about SafetyWing here!

What Should Nomad Travel Insurance Include?

As stated above, not all travel insurance policies are created equal. Here is what you should look for as a traveler or someone diving into the digital nomad life:

- Emergency medical expenses

- Getting you back home if needed

- Trip cancellation/interruption

- Trip delays and cancellation

- Baggage

- Lost, damaged or stolen possessions

- 24/7 emergency services

What is great about SafetyWing is that it was created by digital nomads to solve problems they saw with current travel insurance policies.

They noticed that not only were some of the existing options complicated and pricey for full-time travelers, but they also didn’t allow for much freedom, requiring users to know where they would be traveling and how long for in advance.

The SafetyWing founders saw the need for a more flexible, pay-as-you-go alternative.

They also wanted to offer a solution for nomads who are no longer residents of their home country and who don’t have health insurance there anymore.

Since international travel insurance usually covers users everywhere except in their home country, nomads who go home temporarily as part of their full-time travels are — ironically — left unprotected when visiting home.

What SafetyWing Travel Medical Insurance Covers

So what exactly does SafetyWing travel medical insurance get you?

Here is their policy at a glance:

Robust coverage. With SafetyWing nomad travel insurance, you’ll be covered for unexpected illness or injury. This includes hospital, doctor, and prescription drug expenses (where eligible). Additionally, you’re covered for travel delays, lost checked luggage, non-professional sports and activities, if you need new accommodation due to a natural disaster, accidental death or dismemberment. I know, not fun to think about, but important.

Note that the above is just a small sampling of what is covered. It’s important to review their policy to gain a full understanding of exactly what is or isn’t covered.

A large network. You’ll be covered in any country in the world outside of Iran, North Korea or Cuba. Additionally, you’re not covered if you hold Cuban citizenship.

$250,000 of coverage. Their deductible is very low at $250, too.

Long-term coverage. You can stay subscribed to SafetyWing long-term and don’t need to know how long for in advance. While the policy expires after one year, you can then start a new one.

One overall deductible. Instead of needing to pay a deductible for every claim, you have one low overall deductible of $250 per year.

Access to private health care providers. If you’re in a destination where the public healthcare system isn’t great, this is an important option to have.

One really unique feature:

SafetyWing includes limited coverage in your home country, too, as long as the visit isn’t for an appointment to treat an ailment that began on your trip.

So if you’re home and an accident happens, you have 30 days of at-home coverage (or 15 days in the USA) during every 90-day cycle.

Learn more about SafetyWing here!

SafetyWing Considerations

Here are a few things to consider before purchasing a SafetyWing plan:

There is an age limit. Travelers over the age of 69 cannot purchase a plan.

If you decide later on to visit the US, you need a new plan. Because having US coverage is a different plan altogether, you can’t add this on later. This means you’ll need to cancel and re-purchase a new plan, and your deductible will reset.

How Does Travel Insurance Work?

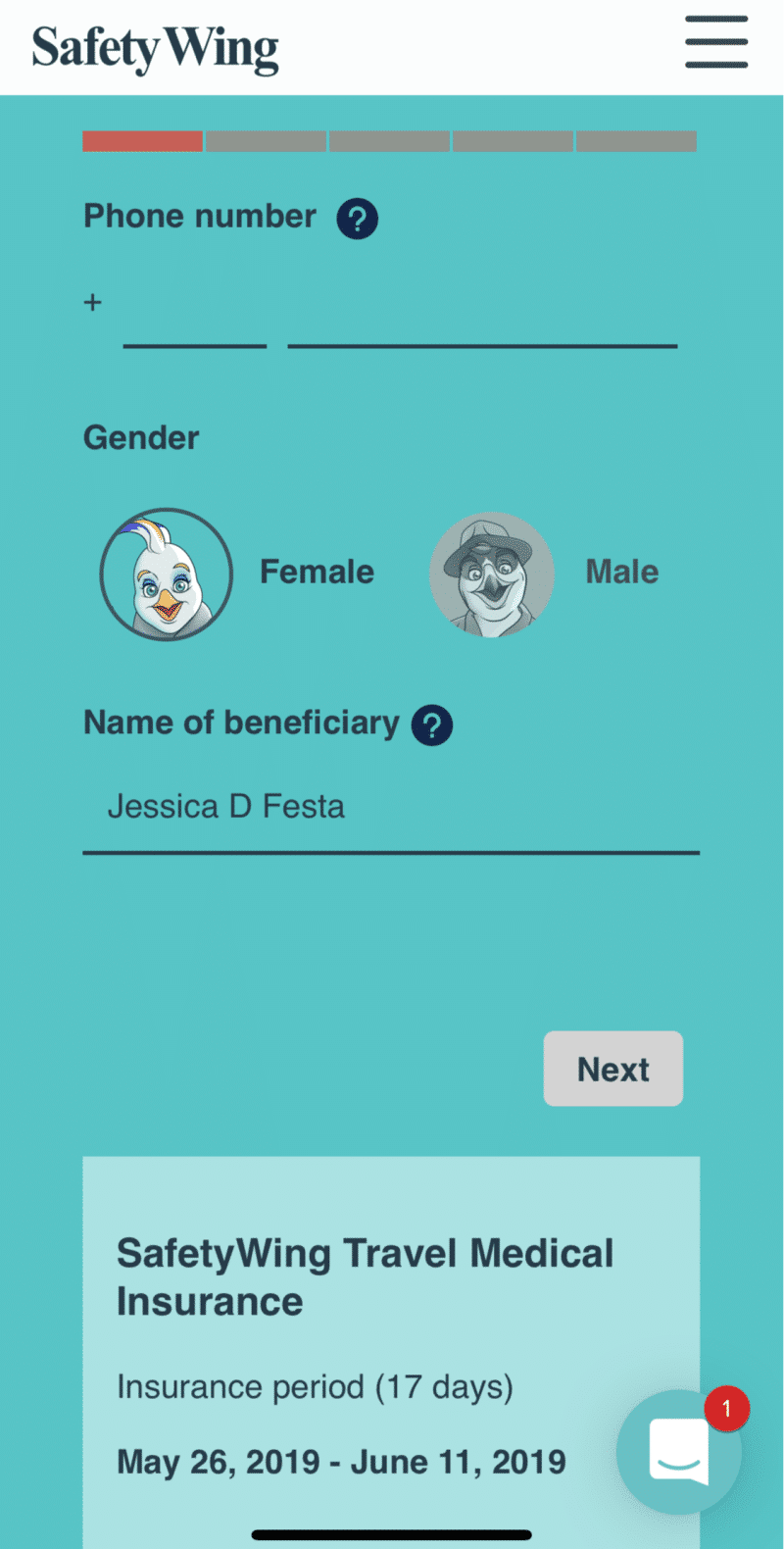

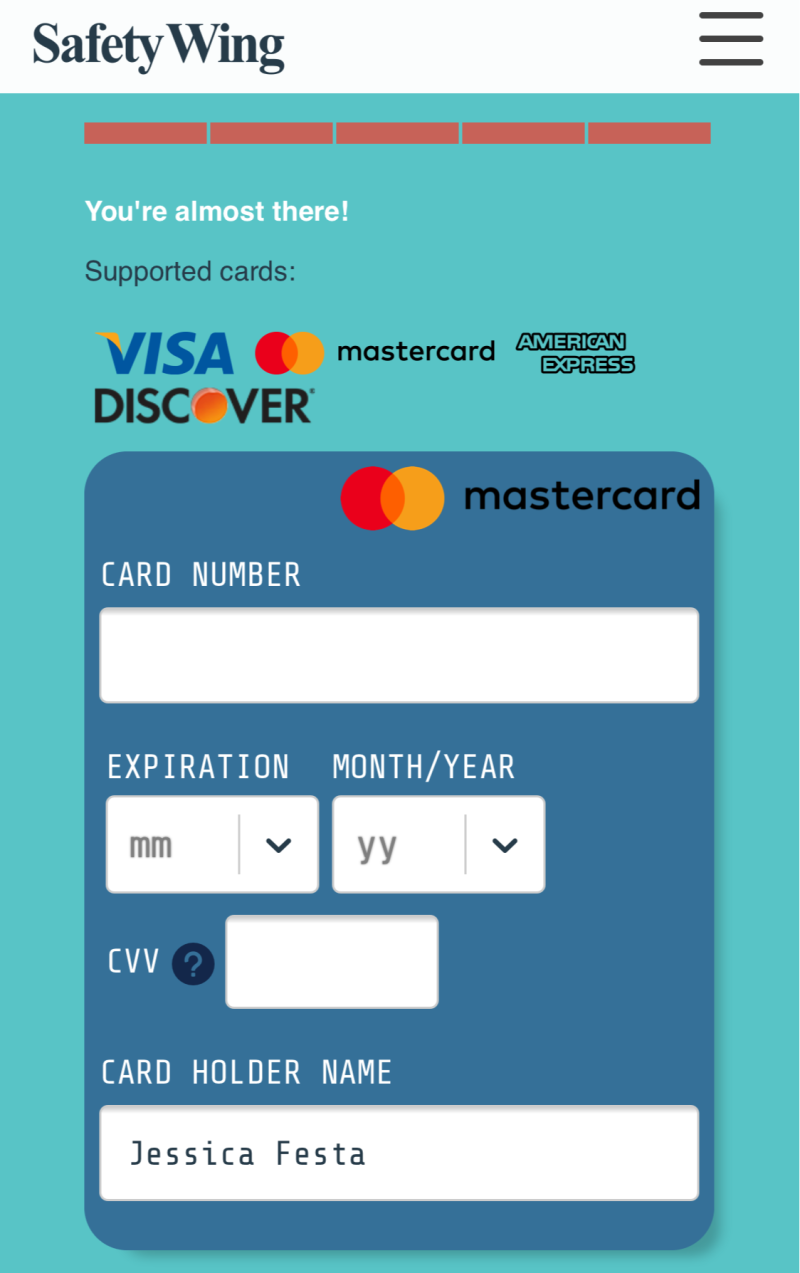

The easiest way to share this is to describe my most recent experience purchasing SafetyWing travel insurance for a hiking trip through Nepal.

The actual process of buying the insurance has a more modern feel in comparison to most other carriers, as you can see here:

As you can also see above, it’s possible to purchase the travel insurance for less than one month to get a pro-rated policy.

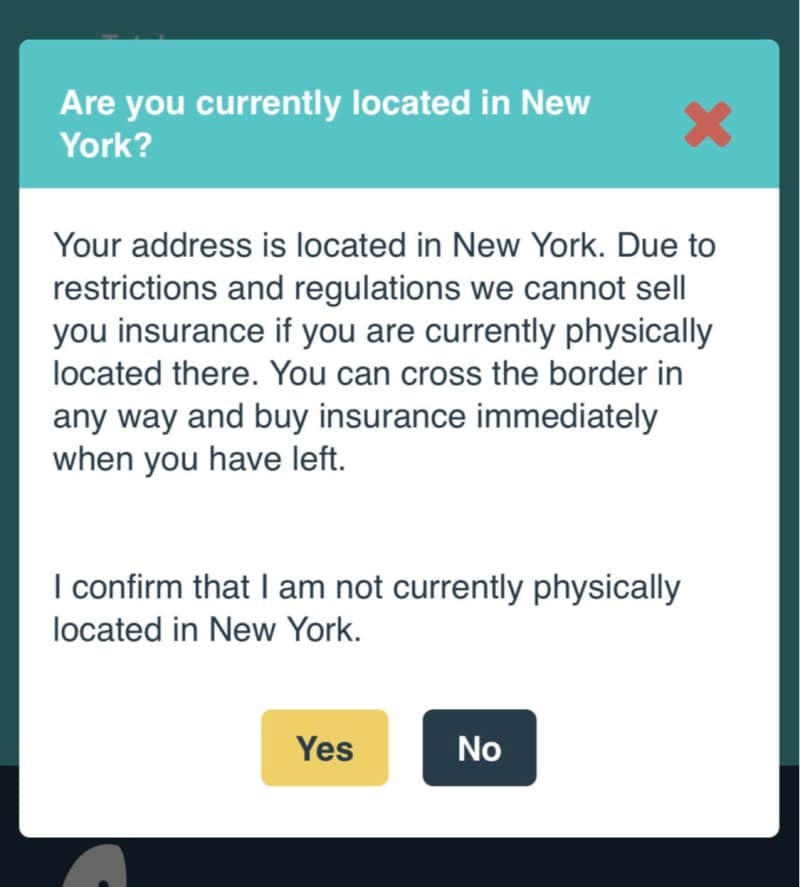

One small problem I ran into had to do with me being a New York resident.

If you live in New York, Maryland, or Washington, you can’t physically be in your home state when you purchase due to local laws.

There is an easy fix though:

Purchase when you’re not physically in the state, such as at the start of your trip, or have a friend purchase for you through your account.

As you can see in the screenshot below, it just takes clicking a button to let SafetyWing know when you’re not physically in the state at the time of purchase. Easy peasy!

Once purchased, I was covered and able to enjoy hiking through Nepal’s Annapurna Region with confidence.

Luckily, I did not run into any issues on the trip and did not need to use the insurance, but it felt good knowing I had that safety net if needed.

Actually, when hiking in Nepal most tour operators will require you to have travel insurance that includes helicopter rescue, as if you get hurt in the mountains this will be your only option. SafetyWing includes this.

The Future Of SafetyWing Insurance

The company already has a great product, though they are currently working to launch the following features:

- Maximum payment limit raised to $1 million

- No deductible

- Electronics/valuables coverage

- Extreme sports coverage (many sports are already covered when practiced casually and with the right equipment, but they will be launching a more comprehensive option to include some of the current exclusions)

Skitterphoto/Pexels.

Additionally, along with their current travel medical insurance product, their goal is to eventually also offer comprehensive health insurance followed by a disability plan and then a pension plan.

In that case, maybe one day full-time travelers actually won’t need to keep their at-home health insurance policies.

This would be a definite game-changer in terms of health insurance for digital nomads.

That statement is particularly true for travelers from countries that void health insurance policies for people who aren’t in their home country for a minimum required amount of time.

Is SafetyWing Travel Medical Insurance Reliable?

While SafetyWing is a younger company, their digital nomad insurance policies are administered by Tokio Marine, one of the world’s largest insurance companies.

Tokio Marine handles claims directly and offers 24/7 support.

Learn more about SafetyWing here!

Finding An Affordable Travel Insurance Plan

Unlike most travel insurance companies where you need to provide a number of details before speaking with someone and getting a quote, SafetyWing works like a subscription.

That is because instead of offering 10+ plans, they offer one robust policy solution.

You’ll pay $45 per month for worldwide travel medical coverage (for travelers aged 18-39, though other ages are available).

Note that travel to the USA adds $31 per four weeks.

Quite often, companies charge $100+ for one month of coverage, so this is a great deal. While writing this article I actually went and got quotes from a number of other companies to confirm this.

Unlike most travel insurance providers, you don’t need to purchase their insurance before your trip, either.

Taking The Headache Out Of Travel Insurance For Digital Nomads

What I really appreciate about SafetyWing is that I don’t need to answer a ton of questions and add up all of my travel expenses just to get taken to a page where I then to need to sift through numerous plan options.

Instead, everything is included in one affordable price.

Learn more about SafetyWing here!

Frequently asked questions about travel health insurance for nomads

Q) What is the best insurance for digital nomads?

SafetyWing is the best insurance for digital nomads. Their insurance is built and designed by remote workers across the world.

Q) How much does SafetyWing nomad insurance cost?

It costs approximately $45 USD for coverage up to 4 weeks. However, the price can differ according to your age.

Q) Can I buy SafetyWing travel insurance for nomads abroad?

Yes, you can buy their insurance before or after you leave your home country.

What do you look for when it comes to travel medical insurance for digital nomads?

Enjoyed this post? Pin this SafetyWing review for later!

Hi, I’m Jessie on a journey!

I'm a conscious solo traveler on a mission to take you beyond the guidebook to inspire you to live your best life through travel. Come join me!

Want to live your best life through travel?

Subscribe for FREE access to my library of fun blogging worksheets and learn how to get paid to travel more!

Ummmm this is awesome, I’ve been waiting for something like this. I hope they are able to expand in the future to be able to totally replace my at-home health insurance and be all-encompassing for me as a traveler. When I worked in the music industry we had something similar for musicians (who are considered freelance, I guess) called Rock For Health. I always thought there should be something like that for travelers, maybe this is it. Right now I just have whatever insurance my seasonal employers provide, and then I have travel insurance when I’m off-season. But there are always months where they don’t overlap correctly, like maybe I’ll have a few weeks where I’m not traveling AND I haven’t started a new job yet (plus when you get a new seasonal job your insurance often doesn’t kick in right away).

Very nice article. Thanks for sharing!

Hey Jessie, $250,000 seems like a lot for regular life (I’ll happily accept $250k from anyone who thinks otherwise!), but for travel medical emergencies I’ve been told it’s on the low end. And anything above that would come out of your pocket. Apparently SafetyWing’s planning to increase it to $1million at some point, but until then what do you think?

Great article. We’ve not purchased travel medical insurance in the past, but I think it is a good idea and plan to make it a habit for all future travel. Your article was very informative and persuasive, so thank you!

The way I see it, if you can’t afford travel insurance, then you can’t afford to travel. I must admit, I’ve never heard of SafetyWings before. I generally use World Nomads. I’ll have to check them out. 🙂